6 Start up Tips for Autochartist

Autochartist will offer specific alerts when customized searches are created to better reflect individual trading preferences.

This allows a trader to have the flexibility to choose:

- Preferred time frames

- Preferred direction - Trends and trend strength

- Pattern size or length

- Minimum requirements for pattern quality

These choices are not mandatory but are recommended as the comfort level grows with use not only of the platform but of the markets in general.

Initially using the default settings is an excellent way to start. Most traders will deviate little from these settings.

Using the default settings will reveal the greatest number of pattern alerts. However to reduce and identify the required types of alerts, Autochartist provides certain criteria that may be altered to reflect a trader’s requirements for set ups. For newer traders this process is invaluable because it requires some forethought about the trading process and reduces the number of set ups. A suggestion for all traders is at the very minimum to select the specific pairs that are traded most often.

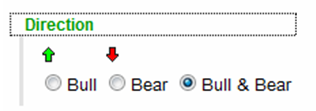

The market direction can be narrowed to show patterns from “Bull” or “Bear” markets only. If a certain direction is preferred then the decision to exclude one can be made here.

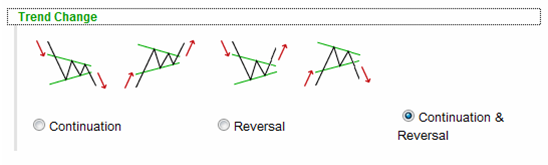

Since most traders do prefer to trade “long” and “short”, the default setting is the “Bull & Bear” setting. Also when looking at market direction, the “Trend Change” allows a trader to choose between “Continuation”, “Reversal”, or both. For example, traders who prefer to trade reversals of the trend or a continuation of the trend can make that exclusion here. Remember, simply because the pattern may be a “Continuation” or “Reversal” pattern does not mean it will necessarily move in that direction to trigger the entry. It is highly recommended that the “Continuation & Reversal” default setting be kept.

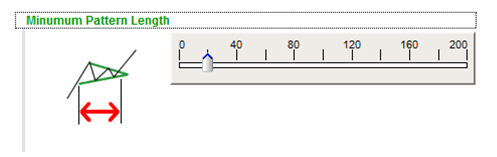

The Pattern size or “Minimum Pattern Length” selection can be adjusted from between 20 candles long to 200 candles. The length which you have selected on the slide will then be the smallest number of candles that form a pattern. Generally speaking, a smaller pattern reflects near term psychology while larger patterns reflect longer term psychology.

This however cannot be decided without considering the time frame itself. A 20 candle pattern on a 240 minute chart is very different to that of a 20 candle pattern on a 15 minute chart, but both are short term relative to their respective time frame.

Keeping the Minimum Pattern Length low at the 20 candle default will alert the greatest number of patterns as the criteria will allow for short and long pattern lengths.

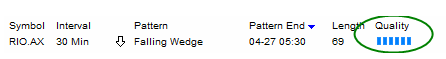

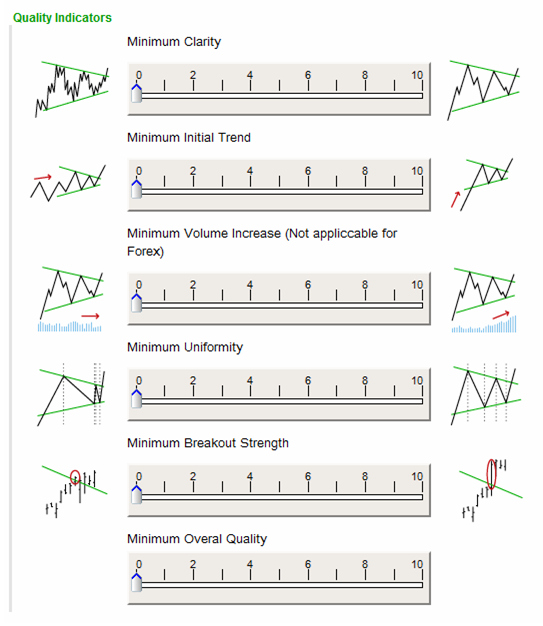

Thus far the search criteria have been simple and for the most part should be left on the default setting. The Quality Indicators are where the more advanced users and traders can be very specific about the patterns that will be alerted.

There are six Quality indicators in total. The “Quality” of a pattern alert is the culmination of three specific indicators. While the overall “Quality” of a pattern can offer some general insight, it’s the “Clarity”, “Initial Trend”, and “Uniformity” that will offer the best, most detailed view of what the pattern is saying about itself and the current market.

These four indicators are best discussed together since they are synergistic. The overall Quality of a pattern alert is in fact calculated by the Clarity, Initial Trend, and Uniformity.

Before making any adjustments, these Quality Indicators must be fully understood. If low quality settings offer the most flexibility in the alerts, then higher readings will exclude more alerts. If you require a lower number of alerts, begin with the Clarity and Uniformity readings as these affect both trending and non-trending patterns the same way.

These last two are “aesthetic” settings since they both reflect the pattern’s price action, support and resistance. “Clarity” as the name suggests, measures the way price action is behaving. If there are gaps, random price action, dramatic or sudden highs or lows (also referred to as “wicking”), the Clarity reading will be lower.

Low Clarity suggests there could be false pattern triggers also called “whipsaws”. This is when prices break a pattern but do not follow through and retract back within the pattern, often going in the opposite direction.

Uniformity has to do with the way price action is behaving within the pattern as it applies to the support and resistance of the pattern. If something is “uniform” it is understood to be constant, consistent, and without variation. In the case of pattern Uniformity, the same idea applies.

A uniform pattern will have even spacing of touchpoints within the pattern. Touchpoints are those highs and lows that indicate the support and resistance of a pattern. Prices will show a similar number of touchpoints at both the support and resistance if the pattern is uniform. When a pattern has good Uniformity it appears as if price action is filling up the pattern.

It is always good to have a high Uniformity reading. Sometimes patterns simply look good; that’s the aesthetic subjectivity that a seasoned trader often can distinguish between patterns. The “Clarity” and “Uniformity” are the more objective readings of pattern aesthetics.

The Initial Trend reading should be kept low. This is simply because trending and non-trending patterns have differing Initial Trend requirements. To say that a high Initial Trend reading is always good would ignore the fact that non-trending patterns such as triangles and rectangles can have low Initial Trend readings. Initial Trend readings must be considered within the context of the pattern type itself. You can review the lessons on trending and non-trending patterns for more discussion on the importance of the Initial Trend.

The remaining indicators are the “Volume Increase” and “Breakout Strength”.

The Volume Increase is not applicable to Forex but is essentially what the name implies: It reads the volume at the time of the pattern break for an increase of market participation.

The Breakout Strength applies only to patterns that trigger a pattern break as price pierces support or resistance. If the momentum (as seen by price movement) increases as the pattern’s support or resistance is pierced this would yield a higher breakout reading. Conversely, less momentum at the pierce would yield a lower breakout reading.

The idea behind Breakout Strength is a powerful one. The lines and levels of a pattern are strong support and resistance and the break of these lines and levels should accompany more market participation and possibly more follow-through.